Financial Reporting Transformation

How a mid-market manufacturer cut month-end close from 10 days to 3 days with automated variance analysis

The Challenge

A mid-market manufacturing company's CFO was frustrated with their month-end close process. The finance team spent 10+ days manually compiling reports from multiple systems, leaving little time for actual analysis before board meetings.

Key Problems:

- Month-end close took 10-12 days - too slow for decision-making

- Variance analysis buried in 50+ tab Excel workbooks

- No clear visibility into what drove P&L changes month-over-month

- Cash flow projections were static snapshots, not rolling forecasts

- Board meetings started with 2-hour financial reviews instead of strategic discussions

- Errors in manual consolidation required frequent corrections

The Solution

We redesigned their financial reporting to automate data consolidation and focus on exception-based reporting. Instead of presenting all numbers, we highlighted only significant variances and their drivers, allowing executives to focus on what matters.

Visual Transformation

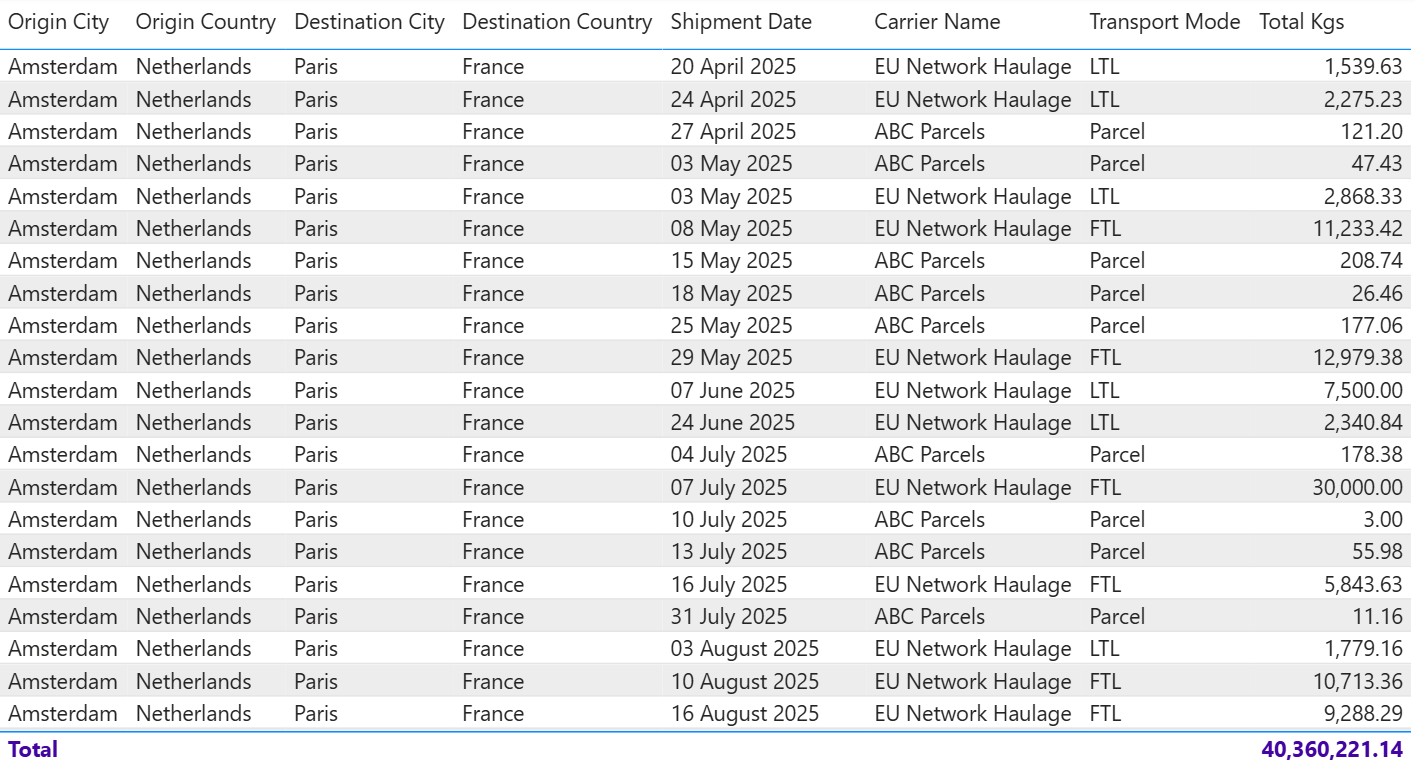

❌ The Old Way: Confusing Tables

Executives had to scan through rows of numbers to find what mattered

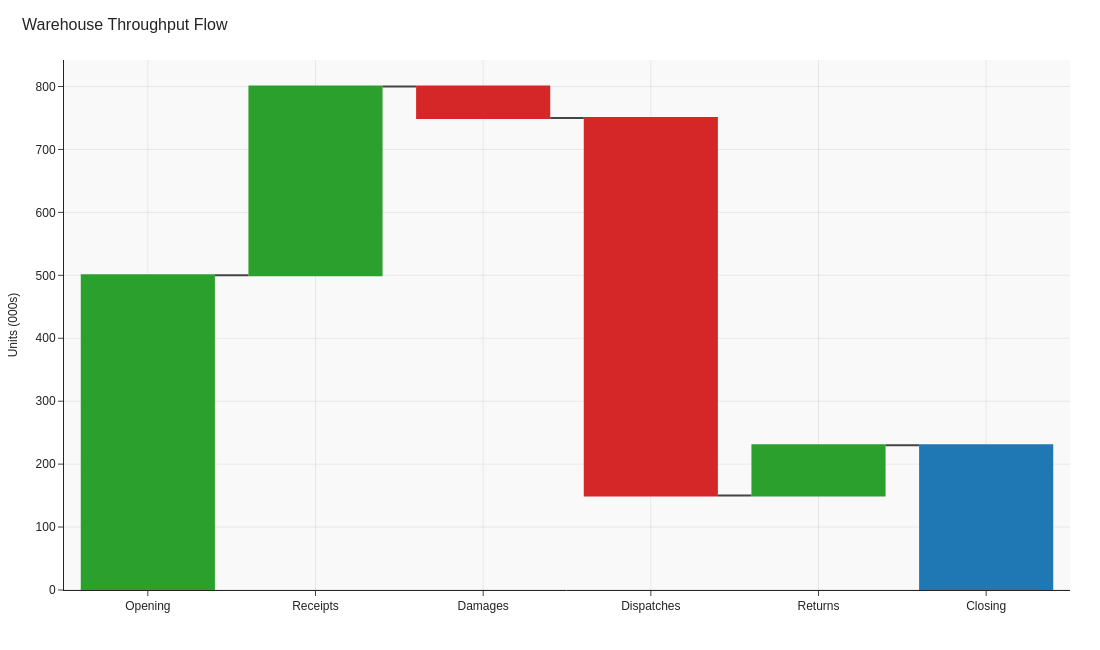

✅ The New Way: Clear Waterfall Charts

Waterfall charts instantly show what drove the $2M revenue increase

Before vs. After

❌ Before

- 10-12 days to close the books each month

- 50+ Excel tabs with manual formulas and links

- Static variance tables with no visual hierarchy

- 2-hour board presentations walking through every line item

- Errors discovered days after initial reports

- No time for forward-looking analysis

✅ After

- 3-day close with automated data pulls

- Single-page executive summary with drill-down capability

- Waterfall charts showing exactly what drove changes

- 20-minute board review focused on exceptions

- Real-time validation catches errors immediately

- Weekly rolling forecasts inform proactive decisions

4 Key Changes That Made the Difference

Automated Variance Analysis Dashboard

What we did: Built automated variance calculations with conditional formatting highlighting variances >10% or >$50K, whichever was lower.

Why it worked: Finance team no longer manually compared thousands of line items. The dashboard immediately showed the 12-15 items that actually mattered, reducing analysis time from 3 days to 4 hours.

Chart type: Heatmap with color-coded variance cells

P&L Waterfall Charts

What we did: Created waterfall visualizations showing month-over-month and year-over-year P&L bridges, breaking down exactly which revenue and cost categories drove changes.

Why it worked: Executives could instantly see "Revenue up $2M, but gross margin down $500K due to material costs." No more hunting through tables. The CFO reported this single change saved 90 minutes per board meeting.

Chart type: Waterfall chart (P&L bridge)

Rolling Cash Flow Forecast

What we did: Replaced static monthly cash snapshots with a 13-week rolling forecast updated weekly, showing actual vs. forecast with variance explanations.

Why it worked: Caught a potential cash shortage 6 weeks in advance (previously would have discovered it with only 1 week to react). CFO negotiated better payment terms proactively instead of emergency firefighting.

Chart type: Line chart with forecast bands and variance annotations

Exception-Based Executive Summary

What we did: Created a single-page summary showing only: (1) Top 5 positive variances, (2) Top 5 negative variances, (3) KPI scorecard, (4) Forward-looking risks/opportunities.

Why it worked: Board members received a 1-page summary instead of a 40-page deck. Meetings shifted from "reviewing numbers" to "discussing strategy." CEO quote: "We finally have time to talk about the future instead of explaining the past."

Chart type: Combination dashboard with scorecards and variance tables

Results

"We went from dreading month-end close to actually having time for analysis. The waterfall charts alone transformed our board meetings - we now spend 10 minutes on financials and 50 minutes on strategy. That's the conversation we should be having."

Technical Implementation

Key Takeaways

- Exception reporting wins: Show only what matters (variances >10% or >$50K), not everything

- Waterfall charts are CFO gold: Instantly show what drove P&L changes without hunting through tables

- Rolling forecasts beat snapshots: 13-week rolling view catches problems 6+ weeks earlier

- Automate consolidation, not analysis: Let systems pull data so finance can focus on insights

- One-page summaries force prioritization: If it doesn't fit on one page, it's not a priority

- Real-time validation saves days: Catch errors immediately instead of days later

Want to transform your financial reporting?

Learn which visualization techniques work best for variance analysis, P&L bridges, and cash flow forecasting.

Explore the Visual Guide