📊 Sales Dashboard Transformation

How we cut reporting time from 4 hours to 15 minutes while improving decision quality

The Challenge

🔥 The Situation

A growing B2B software company was drowning in sales data. Their sales manager spent 4 hours every Monday compiling spreadsheets for the weekly leadership meeting. Even then, executives struggled to extract actionable insights.

The result? Slow decision-making, missed opportunities, and frustrated teams on all sides.

❌ Key Problems

- Time-consuming manual work: Sales manager manually pulled data from 5 different systems into Excel

- Inconsistent reporting: Different metrics calculated differently each week, causing confusion

- Delayed insights: By Monday, the data was already outdated - couldn't react to Friday's trends

- No drill-down capability: Executives asked "why?" but the spreadsheet couldn't answer

- Poor visual design: Color-coded cells looked busy and were hard to interpret quickly

- Version control chaos: Multiple Excel versions floating around via email

The Solution

📊 Visual Transformation

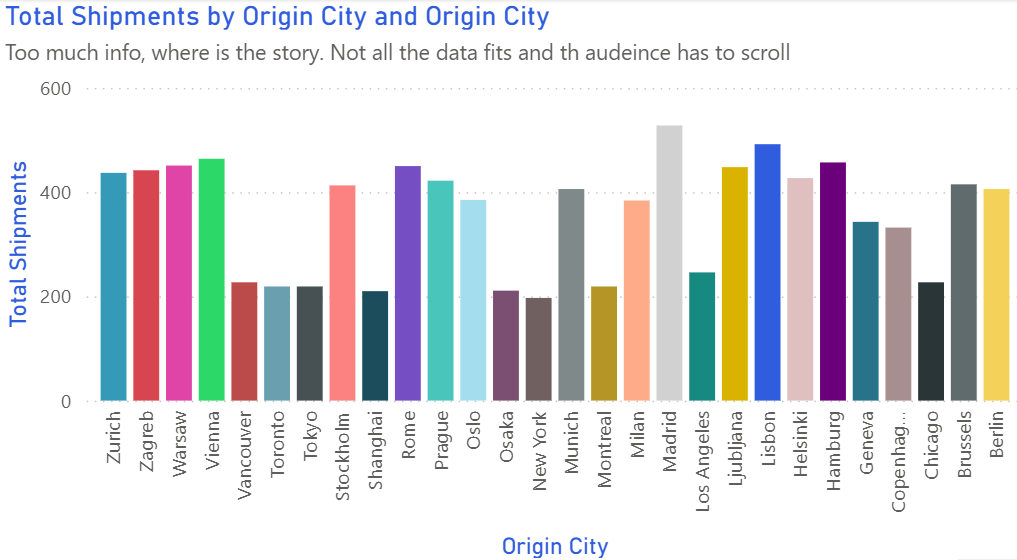

❌ The Old Way: Chart Chaos

Too many colors, no clear hierarchy - which bar should I focus on?

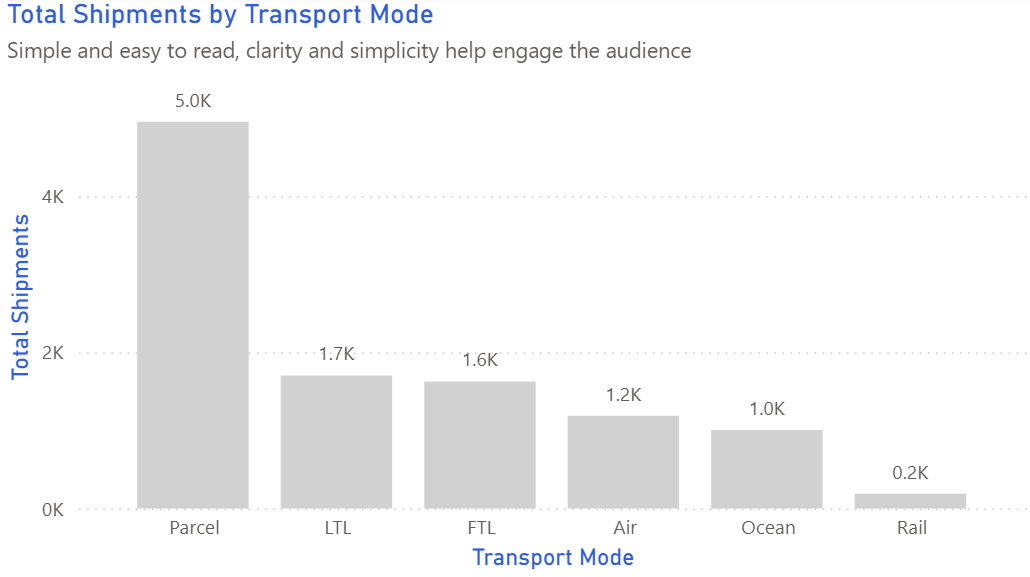

✅ The New Way: Clean & Clear

Single color with highlighted outliers - instantly shows top performers

❌ Before: Spreadsheet Chaos

- 30+ tabs in one massive Excel file

- Color-coded cells (red/yellow/green) everywhere

- 15 different chart types on one sheet

- No clear focal point

- Updated manually once per week

✅ After: Clean Dashboard

- Single-page overview with drill-down

- Consistent color scheme (brand blue/purple)

- 3 core KPI cards + 4 supporting charts

- Clear visual hierarchy

- Real-time data refresh

🔧 Four Key Changes We Made

Before: 20+ metrics scattered across tabs

After: 3 hero KPIs at the top (Pipeline Value, Win Rate, Average Deal Size)

Why it worked: Focus on what actually drives decisions. Everything else became secondary.

Before: All charts the same size, competing for attention

After: Large trend chart showing pipeline over time, smaller breakdowns below

Why it worked: Eyes know where to look first. The big chart tells the story.

Before: Pie charts for trends, 3D bars for comparisons, scatter plots for everything

After: Line chart for pipeline trends, bar chart for rep comparison, funnel for conversion stages

Why it worked: Right visual for the right question = faster comprehension.

Before: Separate tabs for each region/product/time period

After: Single view with dropdown filters for region, product line, and date range

Why it worked: Self-service analysis. Executives could explore without waiting for IT.

✅ The Technical Stack

- Data source: Automated connection to Salesforce CRM

- Tool: Power BI (chose for existing Microsoft stack)

- Refresh schedule: Every 2 hours during business hours

- Access: Web-based + mobile app for on-the-go viewing

The Results

📉 Before Metrics

- Reporting time: 4 hours/week

- Meeting duration: 60 minutes

- Decision speed: 2-3 days

- Data accuracy issues: 2-3 per month

- Executive satisfaction: "Meh"

📈 After Metrics

- Reporting time: 15 minutes/week

- Meeting duration: 20 minutes

- Decision speed: Same day

- Data accuracy issues: 0 (automated)

- Executive satisfaction: "Love it!"

💡 Key Takeaways

- Less is more: We removed 80% of the original metrics. Nobody missed them.

- Start with questions, not charts: "What decision does this enable?" should guide every visualization.

- Automation saves sanity: The sales manager now spends Monday mornings coaching reps, not wrangling Excel.

- Mobile matters: The VP checks the dashboard from his phone during his commute - something impossible with spreadsheets.

- Iterate based on feedback: We launched v1 in 3 weeks, then refined based on actual usage.

Want to Build Better Dashboards?

Learn the visualization principles that made this transformation possible

Explore Visual Guide →